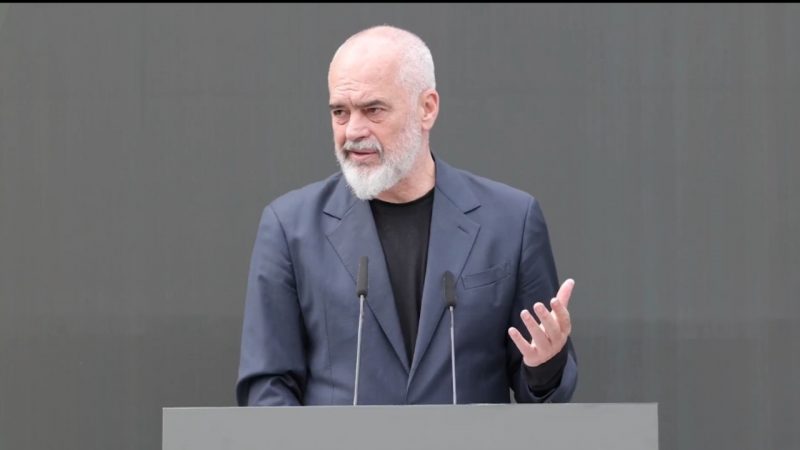

After criticism on media freedom report, PM Rama promises ‘consultations to improve the media environment and the rights of journalists’

After criticism on media freedom report, PM Rama promises ‘consultations to improve the media environment and the rights of journalists’

19/11/2015 15:45

The first fiscal law that will change is the excise one, which increases

the taxes for local beer producers and increases them for import.

According to the draft for beer, excise will increase from 360 ALL per

hectoliter that it is now, to 400 ALL per hectoliter. On the same time,

excise for the import beer reduces from 710 ALL per hectoliter to 600

ALL per hectoliter.

The second tax is the one on insurance. There is a 3% tax of the raw price for every police. From January 1st 2016, the government has proposed to make it 10%.

For the first time this year will have taxes for properties, starting from 1400 ALL per hectare in deep areas, and to 5600 ALL in first category areas such as in Tirana or Durres.

Another tax that will be raised is that of self-employed and free professions, which will be calculated for the maximal salary. This affects lawyers, doctors, notaries, accountants and self-employed dentists.

According to the Ministry, the current system of contribution for these professions is deformed, because a doctor who works in his own business pays three times less than a doctor who is employed in a private office. With the new changes, the contribution for free professions will increase three times, from 6500 ALL to 22.000 ALL in the next year.

Another tax with positive effect in the budget is that of hotels, which will be 140 ALL per night.

Top Channel

After criticism on media freedom report, PM Rama promises ‘consultations to improve the media environment and the rights of journalists’

After criticism on media freedom report, PM Rama promises ‘consultations to improve the media environment and the rights of journalists’ 03/05 16:10