PM Rama is welcomed in Paris by president Macron for the opening ceremony of the Olympic Games

PM Rama is welcomed in Paris by president Macron for the opening ceremony of the Olympic Games

Fiks Fare program reported tonight how a woman is being extorted by an institution that collects bad loans.

One remaining installment from a previous loan has multiplied, and she is threatened that her house will be seized. However, these institutions themselves continue to put this family in a “debt pit”, as they increase the value with enforcement and expert obligations. They even give the total value of these obligations as a new loan, with very high percentages.

The lady from Vlora complained to the newsroom of the investigative show Fiks Fare saying that years ago she took a loan of 1.5 million old ALL. She had not paid an installment, as she has a disabled husband. Then employees of the financial institution Micro Credit Albania took over. They told her say you still have 2 million left to pay, then 3, then 4 million. The complainant says that she was not able to pay it and two MCA employees came to her apartment and gave her a loan. So, loan to cover another loan!

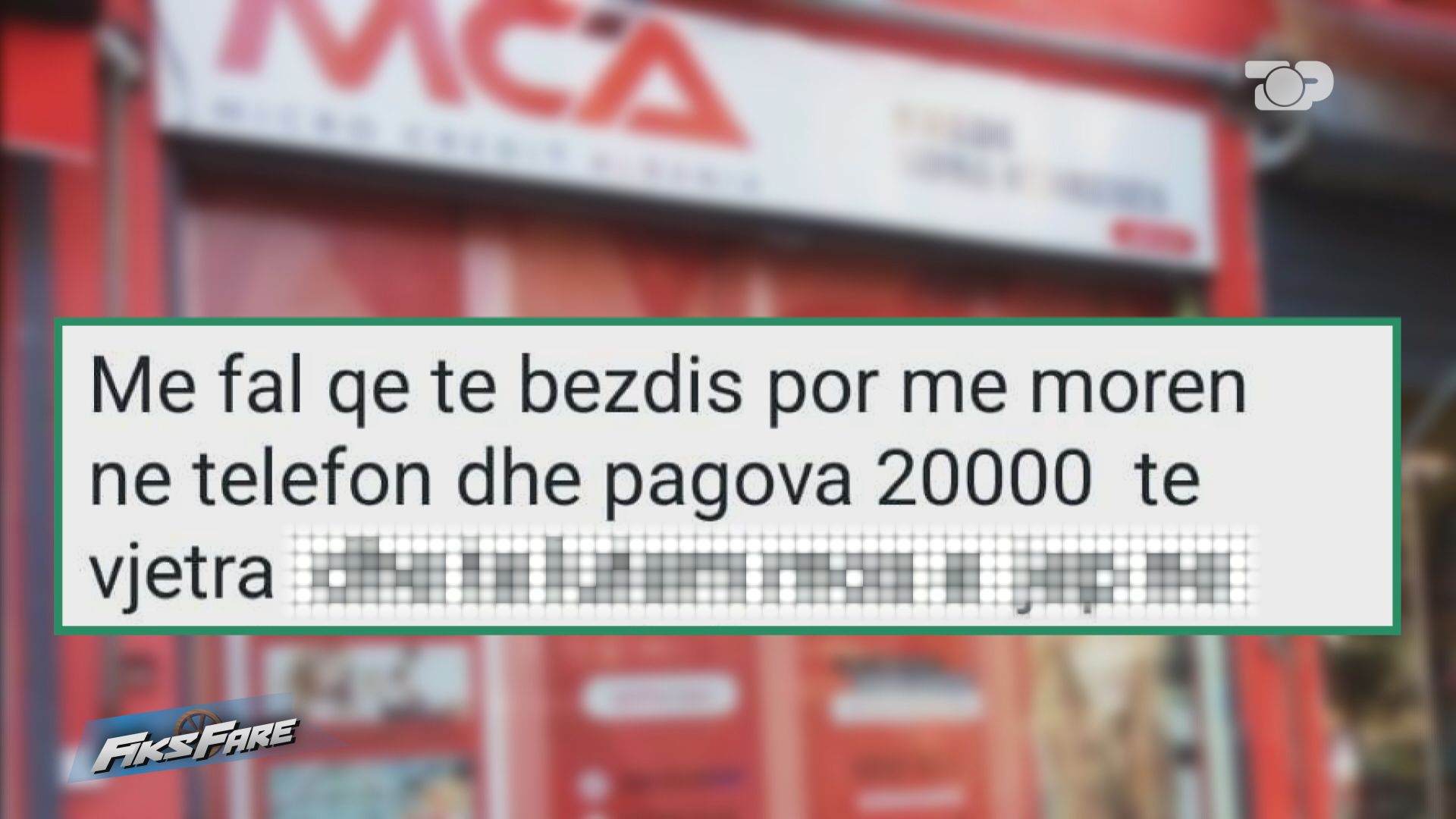

The complainant claims that she did not know what these documents were. “I started paying, once between 50 and 100 thousand lek. I have the invoices and so far I have paid over 5 million old lek. I have all the bills. But now they tell me that we will take the house, I don’t know who to turn to,” says the whistleblower.

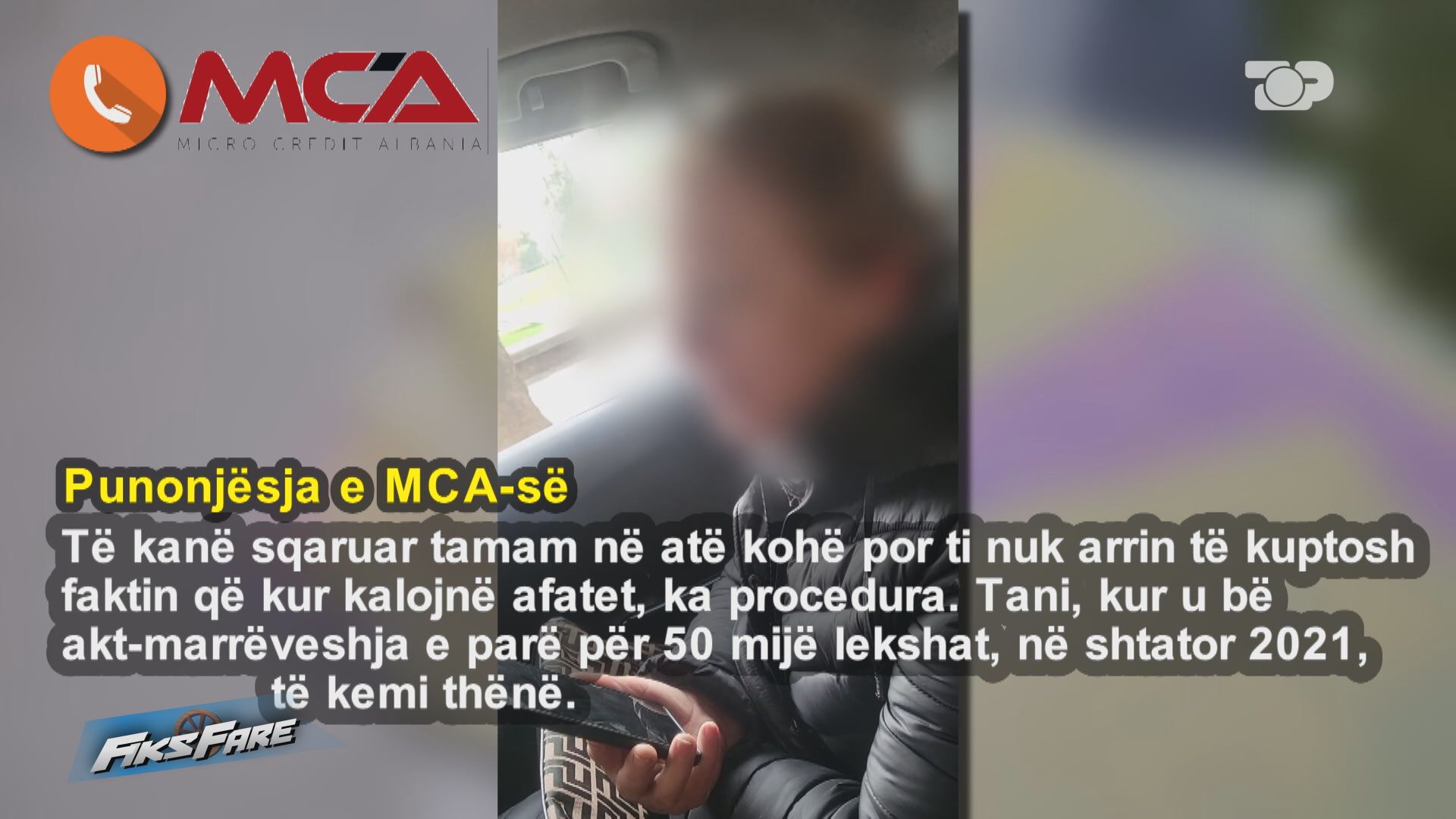

After the complaint, the whistleblower and Fiks Fare associates go to the offices of the MCA agency and talk to the employees. Again they give several versions. The employee tells him that she pays in several installments. “Yes, if you don’t pay one installment, it will be added to the next one. Your case has passed to Enforcement. There are executor costs, expert costs. They have increased in value and a new agreement has been made,” says the employee, adding that she must pay, and threatening that her house will be seized.

After this meeting at the MCA offices, the whistleblower has a phone conversation with another employee. They invite her again to make an agreement. They quote figures and agreements, and tell her several times that “you have to pay so and so”. “We came to your apartment, you made an agreement” they say. The citizen replies that she currently has only 2 million old lek left to pay. “You have a lot, you need a lot of money…” they answer. But they never tell her that she got another loan.

We go MCA offices and the employees claim that you need to make an information request. Fiks Fare asked MCA if for the remaining debt, the lady was given another loan! In response, Micro Credit replies that the loans were granted long ago, but not by them.

The next question was whether the family took a loan to repay the debt?! They answer that it is about restructuring or loan renewal. But, it turned out that by taking on debt, the family got into debt again for the umpteenth time. MCA responds that the debt relationship is ongoing and a new agreement is signed.

Fiksi asks how the loan was given in the apartment, even with a contract not before the notary. They answer that loans in small amounts are not signed in front of a notary. Regarding the loan calculations, which are increasing day by day, the MCA says that the lady has been informed.

A few days after Fiks Fare’s interest, the whistleblower writes that she has made a new agreement with the MCA agency. Unlike the first times, the MCA accepted the agreement of 2 million old lek, which was paid by this family.

Top Channel

PM Rama is welcomed in Paris by president Macron for the opening ceremony of the Olympic Games

PM Rama is welcomed in Paris by president Macron for the opening ceremony of the Olympic Games